Clark Wealth Partners Can Be Fun For Everyone

Table of ContentsThe Buzz on Clark Wealth PartnersOur Clark Wealth Partners DiariesThe Ultimate Guide To Clark Wealth PartnersSome Ideas on Clark Wealth Partners You Need To KnowOur Clark Wealth Partners PDFsSome Known Factual Statements About Clark Wealth Partners The Clark Wealth Partners IdeasClark Wealth Partners Things To Know Before You Buy

Usual reasons to think about a financial consultant are: If your financial situation has come to be extra complex, or you do not have confidence in your money-managing abilities. Conserving or navigating major life occasions like marriage, separation, youngsters, inheritance, or job adjustment that might substantially affect your financial scenario. Browsing the shift from saving for retirement to protecting wealth throughout retired life and how to create a strong retirement revenue plan.New technology has led to even more thorough automated financial tools, like robo-advisors. It depends on you to investigate and identify the ideal fit - https://filesharingtalk.com/members/626317-clrkwlthprtnr. Ultimately, a good monetary expert needs to be as conscious of your investments as they are with their very own, avoiding too much fees, conserving money on tax obligations, and being as transparent as feasible regarding your gains and losses

Getting My Clark Wealth Partners To Work

Gaining a payment on product suggestions doesn't always indicate your fee-based consultant functions against your finest passions. But they might be much more likely to advise services and products on which they earn a compensation, which might or may not remain in your best interest. A fiduciary is legitimately bound to put their client's rate of interests first.

They may comply with a loosely monitored "viability" standard if they're not registered fiduciaries. This basic enables them to make recommendations for investments and services as long as they fit their customer's objectives, risk tolerance, and financial circumstance. This can translate to suggestions that will certainly likewise make them money. On the other hand, fiduciary experts are legitimately obligated to act in their client's benefit as opposed to their very own.

Not known Facts About Clark Wealth Partners

ExperienceTessa reported on all things spending deep-diving right into complicated monetary subjects, shedding light on lesser-known investment opportunities, and uncovering means visitors can work the system to their benefit. As a personal finance expert in her 20s, Tessa is acutely knowledgeable about the effects time and unpredictability carry your investment choices.

:max_bytes(150000):strip_icc()/what-will-a-good-financial-planner-do-for-me-2388442_color2-566eaab6a87b463d951130f508b5aa3e.png)

It was a targeted ad, and it worked. Find out more Check out less.

Not known Details About Clark Wealth Partners

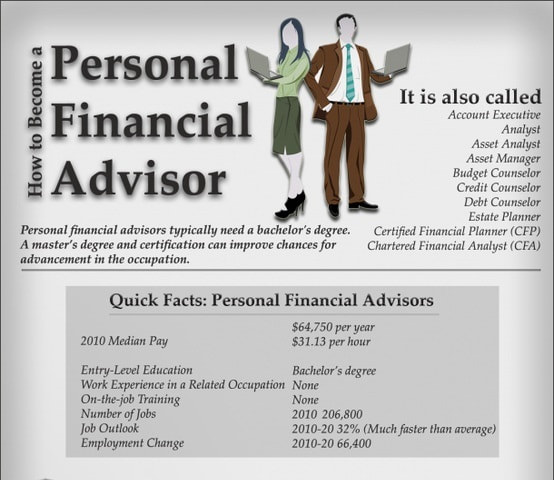

There's no single route to ending up being one, with some individuals beginning in financial or insurance, while others begin in accountancy. A four-year degree provides a solid structure for professions in financial investments, budgeting, and client solutions.

The Only Guide for Clark Wealth Partners

Usual instances consist of the FINRA Collection 7 and Series 65 tests for safeties, or a state-issued insurance coverage certificate for marketing life or medical insurance. While qualifications might not be legally needed for all planning duties, employers and clients frequently watch them as a criteria of expertise. We look at optional credentials in the next section.

Many economic organizers have 1-3 years of experience and familiarity with monetary products, compliance requirements, and straight customer interaction. A strong educational history is important, however experience shows the capacity to apply theory in real-world setups. Some programs incorporate both, permitting you to complete coursework while making monitored hours with teaching fellowships and practicums.

The Best Strategy To Use For Clark Wealth Partners

Early years can bring lengthy hours, pressure to develop a client base, and the demand to continuously verify your experience. Financial planners take pleasure in the opportunity to function closely with clients, overview crucial life decisions, and usually achieve adaptability in timetables or self-employment.

They invested much less time on the client-facing side of the industry. Nearly all financial managers hold a bachelor's degree, and several have an MBA or similar graduate level.

What Does Clark Wealth Partners Do?

Optional accreditations, such as the CFP, commonly need extra coursework and testing, which can expand the timeline by a pair of years. According to the Bureau of Labor Data, personal monetary consultants earn a typical annual yearly wage of $102,140, with leading earners earning over $239,000.

In other districts, there are regulations that need them to meet particular demands to use the economic expert or financial planner titles (st louis wealth management firms). What sets some financial experts besides others are education, training, experience and qualifications. There are numerous classifications for financial consultants. For monetary organizers, there are 3 usual classifications: Licensed, Personal and Registered Financial Planner.

Everything about Clark Wealth Partners

Where to discover a financial consultant will certainly depend on the kind of suggestions you require. These organizations have personnel who might help you understand and acquire specific kinds of investments.